CASE STUDIES

WHY MULTIFAMILY

Multifamily Real Estate

A basic human need

Apartments address the basic human need for "a roof over our head". Whether the economy is going up or down, people need a place to live. During the last housing crisis, multifamily investments had a default rate of .02% compared to single family homes at 6%.

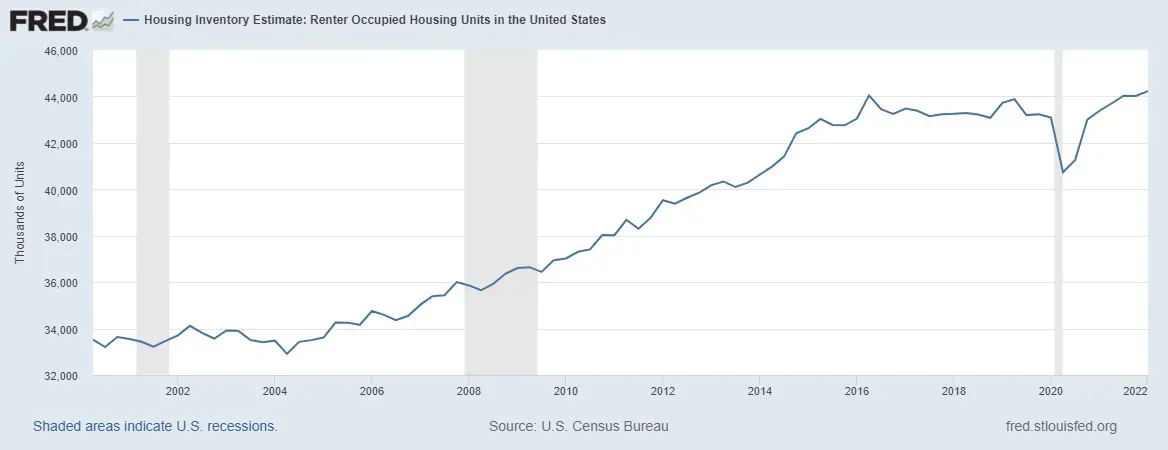

Not to mention that demand for apartments is at an all-time high, population is continuing to increase which drives the demand for apartment living higher and higher. Low vacancy rates equals greater cashflow as well as equity growth, which translates to higher returns for our investors.

Demand for apartments is at an all-time high and still climbing

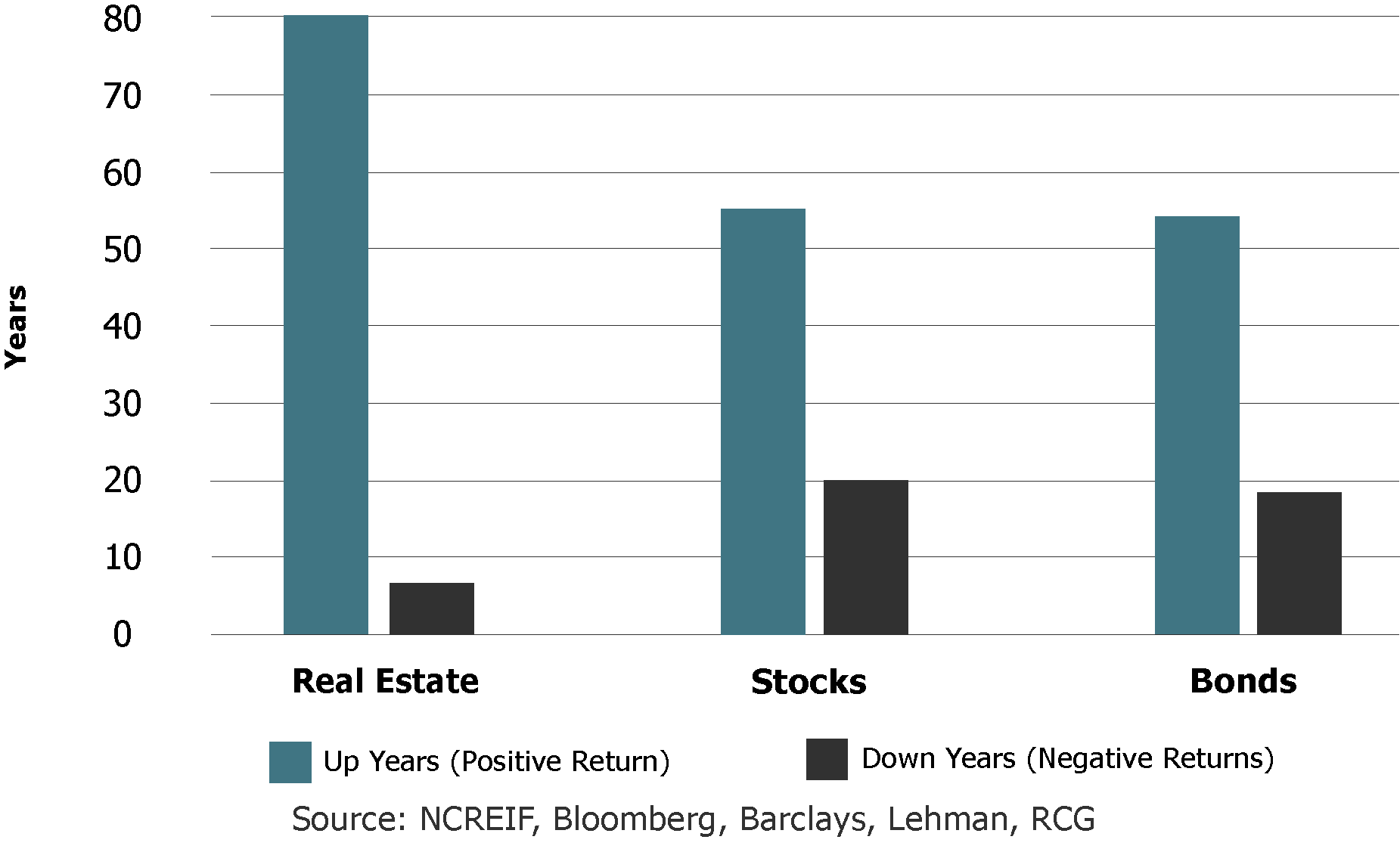

Apartments have historically outperformed stocks & bonds

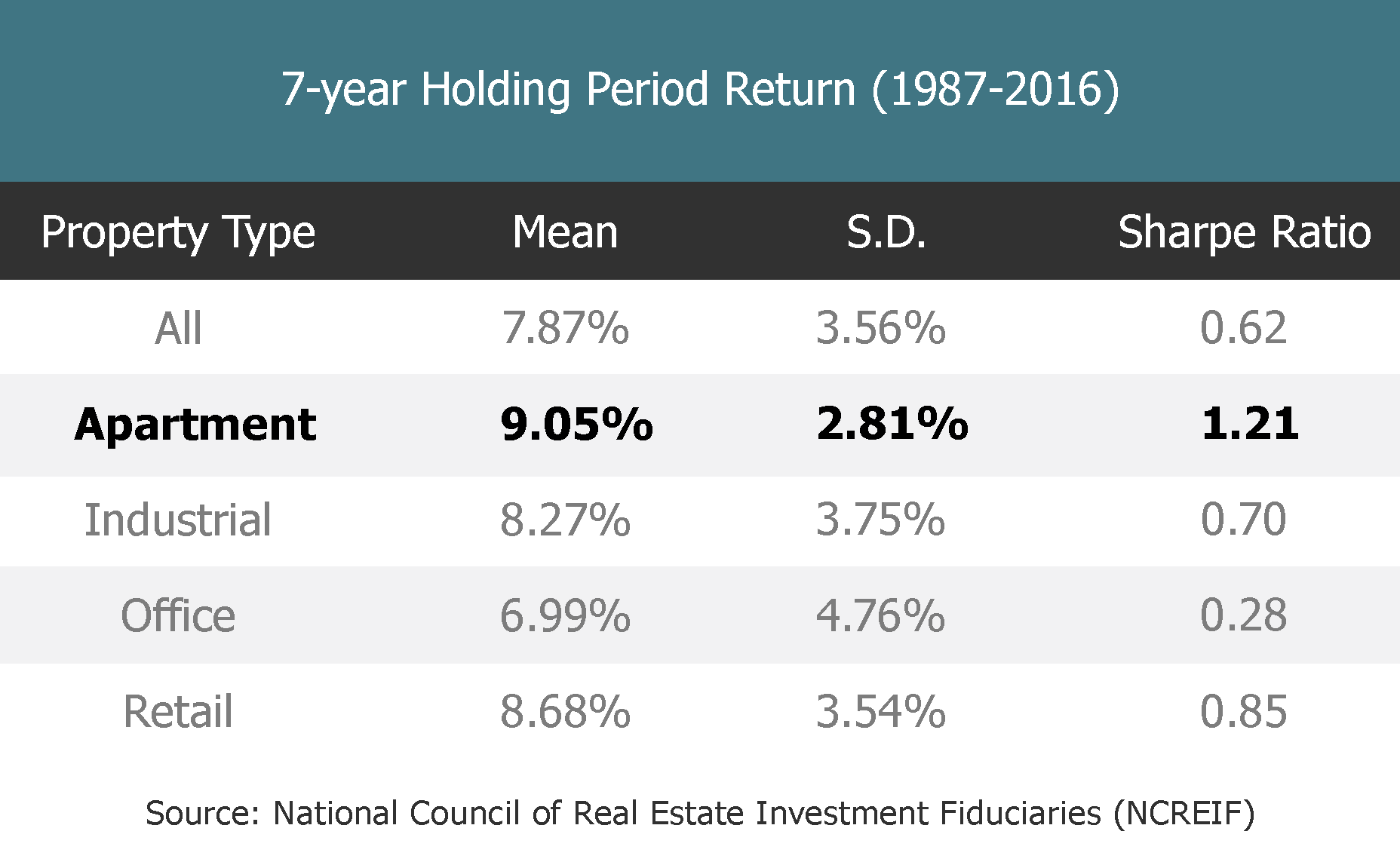

Multifamily investments have historically out performed other real estate classes

Explore how Maynard Capital Group’s diversified real estate syndications can drive wealth creation. Our case studies, including a real Tennessee multifamily deal we evaluated, illustrate potential opportunities across multifamily, NNN retail, industrial, hotels, and alternative assets, targeting 8-20% returns. These scenarios reflect our disciplined approach, offering insights for accredited investors.

Disclaimer: Case studies are illustrative, with the Tennessee deal reflecting a real evaluation but not a completed transaction. Projected returns are targets and not guaranteed. Consult financial advisors.

Our Approach

Our team, with over 27 years of real estate experience, sources high-potential assets through rigorous market analysis and due diligence. For example, we evaluated Harmony Square Apartments, a 66-unit Class A complex in Clarksville, Tennessee, targeting a 15% IRR via rent optimization in a high-growth market (5.4% vacancy, CBRE 2025). Though not pursued due to strategic alignment, this showcases our commitment to capital preservation and transparency.

Multifamily Investment Case Study

Scenario: Evaluated Harmony Square Apartments, an $11.2M, 66-unit Class A townhome community in Clarksville, TN, built in 2022. Rent increases of $197-$210/unit address loss-to-lease, leveraging a 6% purchase cap rate in a high-growth market (CoStar, 2025).

Investment: $600,000 stake in a $4.5M equity raise, with $736,427 in closing costs, held for 5 years.

Projected Outcome: 15% IRR, 6% annual cash-on-cash return yielding $36,000 in passive income, and a 2x equity multiple delivering $1.2M in total returns.

Learn More: Harmony Square Case Study for photos, video, and market data.

NNN Retail Investment Case Study

Scenario: A $5M single-tenant retail property with a 15-year lease, offering 6-8% cap rates (JLL, 2025).

Investment: $250,000 stake in a $1M syndication, held for 10 years.

Projected Outcome: 7% return, generating $17,500 annual passive income.

Learn More: NNN Retail Case Study

Industrial Investment Case Study

Scenario: A $15M warehouse in a logistics hub with 12% demand growth (Cushman & Wakefield, 2024).

Investment: $750,000 stake in a $3M syndication, held for 5 years.

Projected Outcome: 12% return, yielding $90,000 in passive income and $200,000 in appreciation.

Hotel Investment Case Study

Scenario: A $12M select-service hotel in a travel market with 4.5% RevPAR growth (STR, 2025).

Investment: $600,000 stake in a $2.5M syndication, held for 8 years.

Projected Outcome: 11% return, delivering $66,000 in passive income and $180,000 in equity gains.

Agricultural Land Investment Case Study

Scenario: A $3M vineyard parcel in a high-demand region, leased to an agribusiness under an NNN ground lease for wine grape production, with the tenant covering all improvements and management costs, yielding stable income and 7% annual land value growth (USDA, 2024).

Investment: $150,000 stake in a $600,000 syndication, held for 12 years.

Projected Outcome: 10% IRR, 6% annual cash-on-cash return yielding $9,000 in passive income, and a 1.5x equity multiple delivering $225,000 in total returns.

Mining Land Investment Case Study

Scenario: A $2M raw land parcel with mineral potential, developed through resource exploration (e.g., gravel or lithium) and sold at a premium after proving reserves, leveraging strong demand in resource markets.

Investment: $100,000 stake in a $400,000 syndication, held for 3 years.

Projected Outcome: 15% IRR and a 2x equity multiple delivering $200,000 in total returns upon sale, with no ongoing cash flow due to the development and sale strategy.

Start Your Investment Journey

Seize limited real estate syndication opportunities with Maynard Capital Group. Download our investment guide or contact us now to explore tailored investment options and build your portfolio.

Disclaimer: Projected returns are illustrative and not guaranteed. Investments carry risks; consult advisors.

BENEFITS OF INVESTING IN MULTIFAMILY ASSETS

TAX ADVANTAGED INCOME

Investors utilizing leverage depreciation, cost-segregation and Section 1031 exchanges can defer taxation on much of their real estate income into perpetuity.

HEDGE AGAINST INFLATION

Multifamily property values have proven to be virtually a perfect inflation hedge - .98 correlation since 1978 when reliable data became available.

HEDGE AGAINST RECESSION

JP Morgan looked at the worst five-year periods for various investments from 1977-2012 and calculated total return (including cash flow). $100 invested in apartments at the beginning of the worst five-year period for real estate was worth $110 at the end. A portfolio of 60% stocks/40% bonds was worth $94 at the end of its worst five years.

SUPERIOR RISK-ADJUSTED RETURN

For decades, multifamily has exhibited the least volatility and highest risk-adjusted returns of all real estate asset classes. This long-term performance along with tax and hedging benefits has been amplified in the short term.

Learn How To Become An Investor With Us

We welcome inquiries from investors seeking multifamily investment opportunities.

Learn How To Become An Investor With Us

We welcome inquiries from investors seeking real estate investment opportunities.

Helpful Links

About Us

Why Multifamily

Our Investment Strategy

FAQ

Maynard Capital Group focuses on sourcing cash flow multi-family assets with in emerging markets in order to grow and protect our passive investors’ capital

Helpful Links

About Us

Case Studies

Our Investment Strategy

FAQ

Maynard Capital Group focuses on sourcing cash flow multi-family assets with in emerging markets in order to grow and protect our passive investors’ capital

©2024 Maynard Capital Group. All Rights Reserved.

Privacy Policy I Terms

©2024 Maynard Capital Group. All Rights Reserved.

Privacy Policy I Terms